Return to menu

Having helped DIY investors successfully invest in the Australian share market for over 30 years, we know the value of a well diversified portfolio.

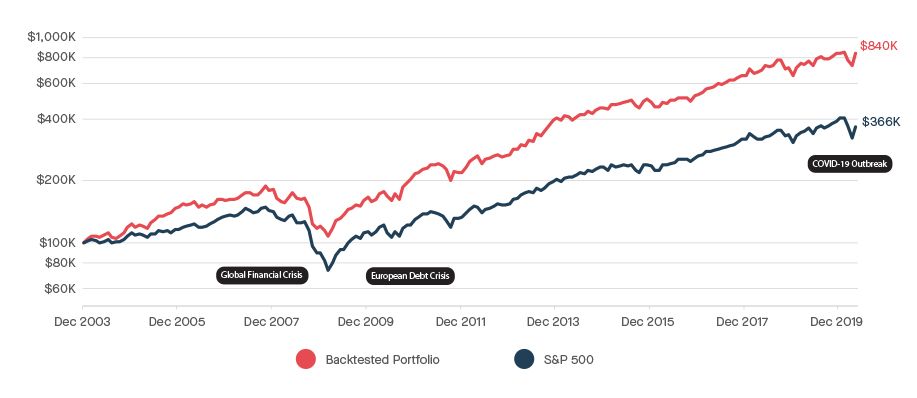

Using the foundations of our quantitative financial health methodology, we spent two years optimising our trusted methodology for the U.S. market. Using a multi-factor model and our Financial Health overlay we have been able to identify a portfolio of financially healthy stocks that are ideal for long term growth.

The end result is our Lincoln U.S. Growth Funds, a Hedged and Unhedged Fund designed for Australian DIY investors who are looking to capitalise on long-term growth in the U.S. market.

By Tim Lincoln Managing Director and Chief Investment Officer

As at 31 Jan 2024

The Lincoln U.S Growth Fund has employed a tactical position aimed to reduce risk/volatility in our managed fund portfolio. Our defensive strategy was executed in August 2023 which involved the Fund hedging its equity exposure with the ProShare Ultra Short S&P500 ETF (SPXU). Our decision has the effect of neutralising the impact of market fluctuations on the unit prices for our investors. However, as intended., investors in the Lincoln U.S. Growth Fund Unhedged will still be exposed to fluctuations in the Australian Dollar / US dollar pair.

What this means is that we have taken the broad market moves out of our total return profile. Therefore, our unitholders won’t participate in market rallies, but likewise, they will not be impacted by market corrections. The unit prices are now solely determined by how well the stocks that we invest in perform relative to the broader market. If they outperform, unit prices will go higher and vice-versa.

Many of our clients that know me personally, are surprised with my bearish view and the tactical portfolio positioning, as I am usually 100% invested and block out the noise. But this time, I truly believe the market has not priced in the lag effect that a higher interest rate environment will have on company earnings and the subsequent ramifications that could follow for markets.

The extraordinary market rally that transpired to end 2023 has had an impact on our relative returns to the S&P500 Total Return Index. The Fund team are prepared to endure the short term underperformance relative to market because we have high conviction that capital preservation tactics are the prudent measure to take in a highly uncertain economic environment. For more information, please contact our Fund Team directly on 1300 676 333.

(a) 01/07/2020 is the inception date of the Lincoln U.S. Growth Fund Hedged and Lincoln U.S. Growth Fund Unhedged funds.

(b) Total Fund return is inclusive of income paid and payable to the Fund to unit holders, in addition to the difference in exit prices for the relevant periods net of management fees, ongoing fees and expenses, and assume distributions are reinvested and that no tax is deduct Performance quoted is historical actual performance. Investments go up and down. Past performance is not a reliable indicator of future performance.

(c) S&P 500 Total Return Index is sourced from Standard and Poors.

All Lincoln Indicators Managed Funds are established to provide investors with maximum peace of mind about the security of their investments. Not only do we invest in financially healthy companies that have a low risk of failure, but we also hold all client investments in a segregated trust with our custodian J.P. Morgan Chase Bank. Furthermore we are regulated by the Australian Securities and Investment Commission (ASIC) in Australia with strict regulatory requirements which govern exactly what we can and can’t do.

| Investment Type |

Lincoln U.S. Growth Fund Unhedged Exposed to currency risk |

Lincoln U.S. Growth Fund Hedged Protected from adverse currency fluctuations |

|---|---|---|

| Minimum Suggested TF | 5 Years | 5 Years |

| Minimum Initial Investment | $5,000 | $5,000 |

| Minimum Additional Investment | $1,000 | $1,000 |

| Management Fee (p.a) | 1.0% | 1.0% |

| Performance Fee (p.a.) | 20% of outperformance of the benchmark | 20% of outperformance of the benchmark converted to AUD |

| Entry/exit Fees | nil | nil |

| Minimum Withdrawal | $1,000 | $1,000 |

| Minimum Balance | $5,000 | $5,000 |

| Buy/Sell Spread | 0.25% / 0.25% | 0.25% / 0.25% |

| Distribution Frequency | Annual | Annual |

| Date of inception | 1 July 2020 | 1 July 2020 |

If you invest in the Unhedged fund, you are exposed to fluctuations in the Australian dollar. This can be a good thing if our dollar falls relative to the US dollar. For example, if you were invested in the Lincoln U.S. Growth Fund Unhedged and the value of the Australian dollar decreased relative to the US dollar, then the value of your portfolio would increase. Of course it can also work the other way around.

If you invest in the Hedged fund, we use strategies to offset the impact of currency fluctuations. This means if you invest in the Lincoln U.S. Growth Fund Hedged you are protected from the adverse impact of a rising Australian dollar. But equally, you don’t get to benefit from situations where the Australian dollar is falling.

If you have a strong view on where the Australian dollar is heading, you could favour one approach over the other.

Distributions are paid annually, with the option to reinvest or receive cash directly in to your nominated bank account.

No, the Lincoln U.S. Growth Fund has no minimum investment timeframe and you will not be penalised if you decide to redeem your funds within a short period of time. But we suggest a minimum of 5 years to allow an adequate timeframe for the Fund to deliver on its long-term objectives.

Lincoln U.S. Growth Fund Hedged: The performance fee is 20% p.a. of outperformance of the S&P 500 Accumulation Index (USD).

Lincoln U.S. Growth Fund Unhedged: The performance fee is 20% p.a. of outperformance of the S&P 500 Accumulation Index converted to Australian Dollars.

To discuss the future of your investments in detail, book in a free consultation with a Lincoln representative.

To discuss the future of your investments in detail, book in a free consultation with a Lincoln financial expert.