Return to menu

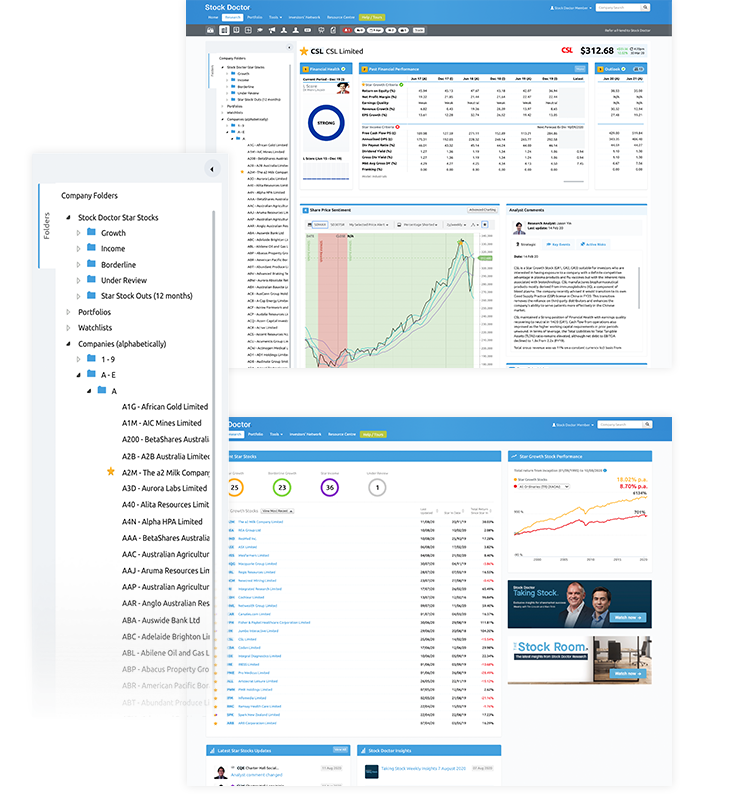

Since 1996 Stock Doctor has been helping self-directed investors and self-managed super funds (SMSF) enjoy investment success. Members gain access to exclusive quantitative research that identifies both the stocks at risk of corporate failure and our Star Stocks – the stocks identified by our exclusive research methodology as having strong financial health and suited to meeting an investors long-term growth or income objectives.

Stock Doctor also provides the essential tool set you need to create, manage and optimise your portfolio, plus gives you the confidence and control you need to achieve long-term success through our renowned support and training programs.

Exclusive to members, our Star Stocks are those identified by our exclusive methodology to be the most superior stocks on the Australian Stock Exchange (ASX) for income and growth. Star Stocks aren’t just your high-profile blue chips, they include the small-to-mid-cap stocks many investors wished they heard about earlier.

Gain immediate access to dependable, market-leading, time-critical stock research on over 2000 companies listed on the ASX. Including Stock Doctor’s renowned Star Stocks. Empowering you to confidently make informed investment decisions in a timely manner.

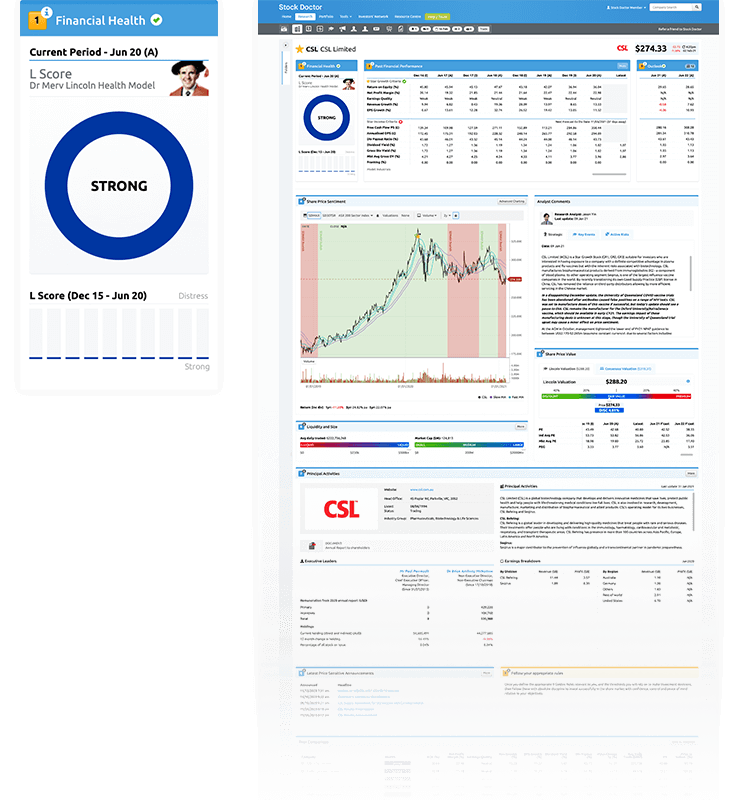

Know your research is based on facts and figures instead of hunches and opinions with Stock Doctor’s proprietary quantitative methodology, laid out using our 9 Golden Rules framework to give you a logical and consistent format to help you easily make rational investment decisions.

Develop your own investment strategy or base your choices on one of our pre-defined strategies, created to suit a wide variety of investors, risk tolerances and life objectives.

Get all the support you need to master our powerful platform with your own dedicated member liaison, plus direct access to our analysts and our online Stock Doctor training modules, as well as regular member events online and in person.

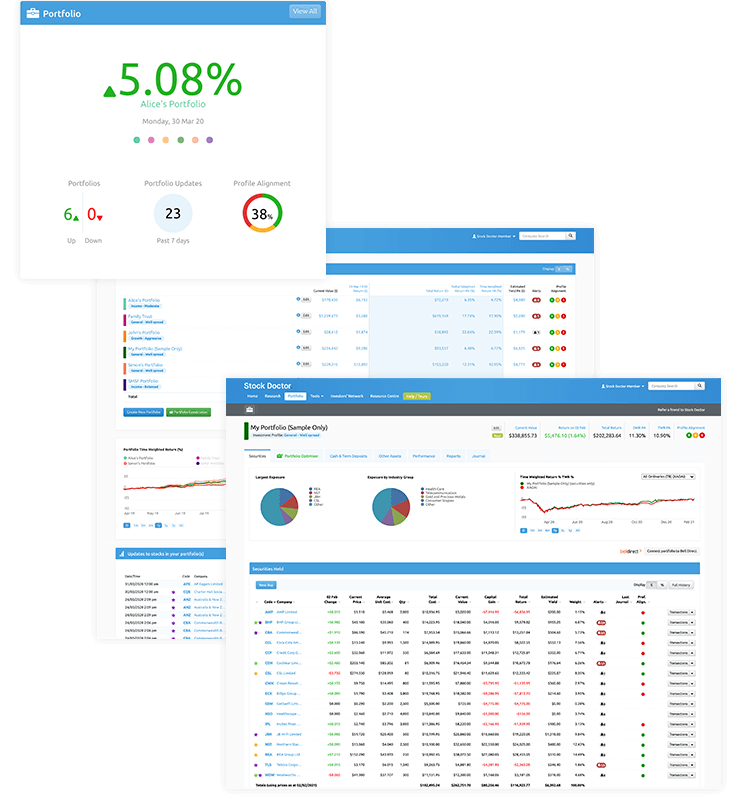

Seamlessly monitor, manage, and optimise your entire investment portfolio in Stock Doctor’s powerful Portfolio Manager. Directly import trade history from your online broker, track performance, seamlessly prepare tax reports and dynamically keep your stocks aligned with your stated investment objective.

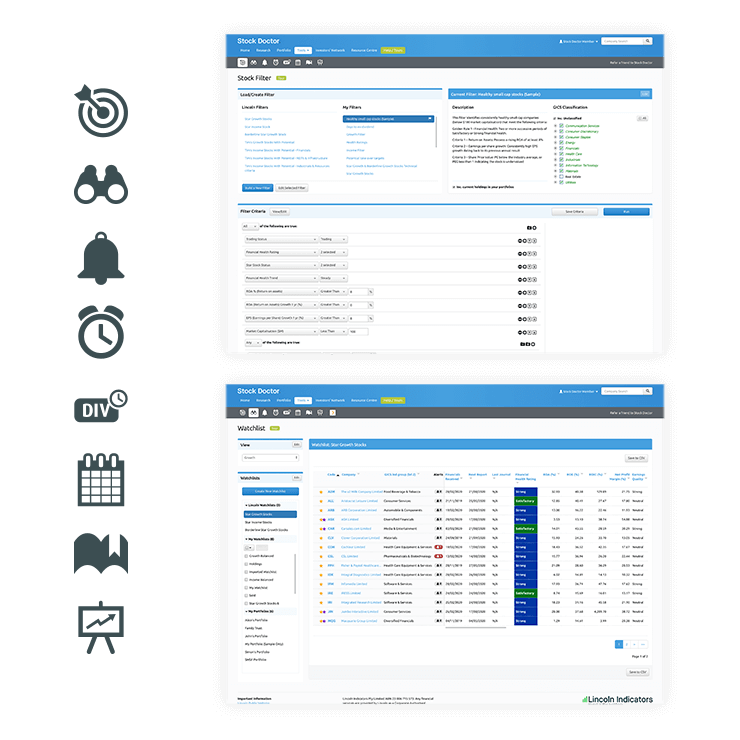

Use our Stock Filtering tool to uncover the hidden gems, set up Watchlists to keep you informed when an opportunity arises, prepare Dynamic Alerts to warn you when you need to act, let the Corporate Calendar tell you when critical company events are coming and track your own decision-making process with our Personal Trading Journal.

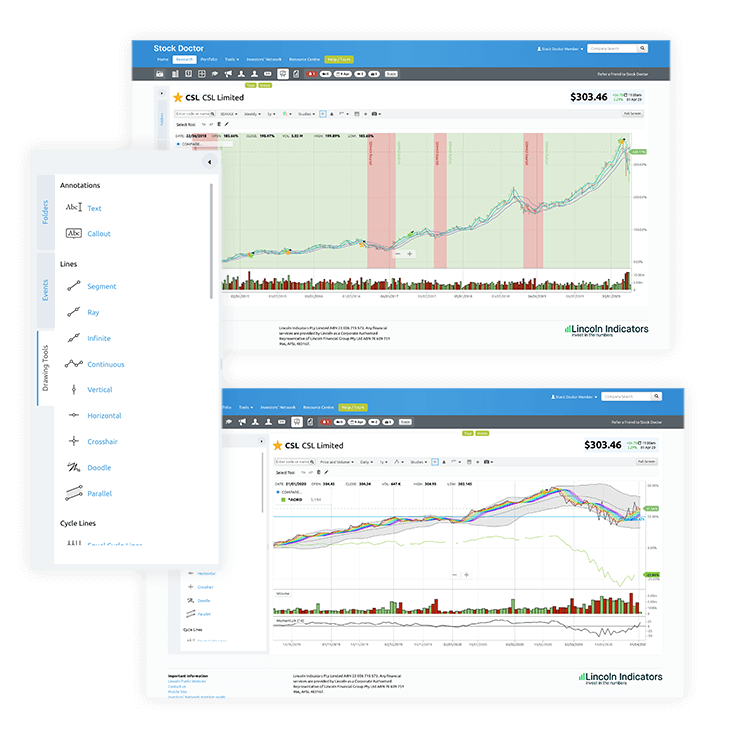

Use our charting tools to combine technical analysis with our proprietary quantitative methodology. With 13 chart types, 33 drawing tools and over 100 studies (including our proprietary studies) to assist with your buy and sell decisions.

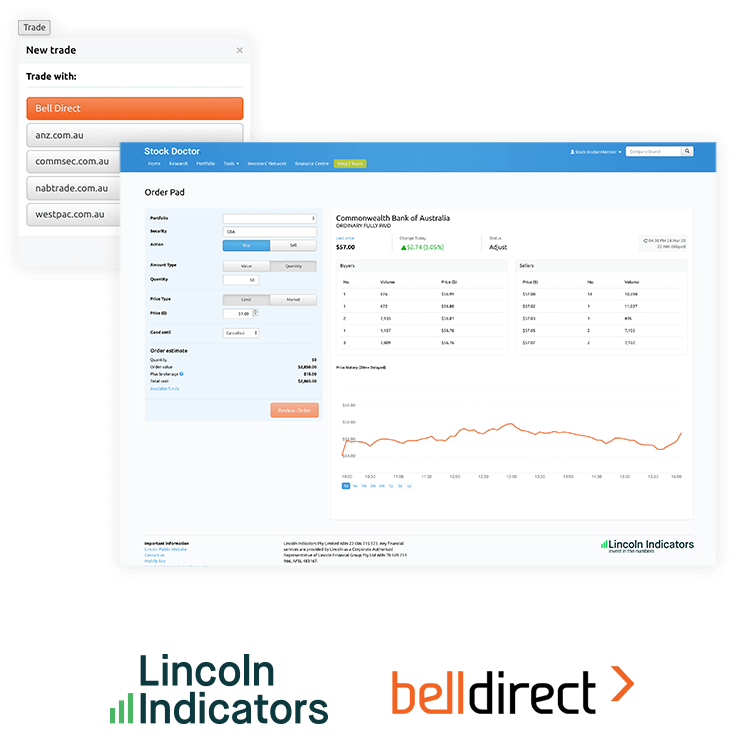

Trade directly through our interface with Bell Direct – an optional extra for all our members.

Gain immediate access to dependable, market-leading, time-critical stock research on over 2000 companies listed on the ASX. Including Stock Doctor’s renowned Star Stocks. Empowering you to confidently make informed investment decisions in a timely manner.

Know your research is based on facts and figures instead of hunches and opinions with Stock Doctor’s proprietary quantitative methodology, laid out using our 9 Golden Rules framework to give you a logical and consistent format to help you easily make rational investment decisions.

Develop your own investment strategy or base your choices on one of our pre-defined strategies, created to suit a wide variety of investors, risk tolerances and life objectives.

Get all the support you need to master our powerful platform with your own dedicated member liaison, plus direct access to our analysts and our online Stock Doctor training modules, as well as regular member events online and in person.

Seamlessly monitor, manage, and optimise your entire investment portfolio in Stock Doctor’s powerful Portfolio Manager. Directly import trade history from your online broker, track performance, seamlessly prepare tax reports and dynamically keep your stocks aligned with your stated investment objective.

Use our Stock Filtering tool to uncover the hidden gems, set up Watchlists to keep you informed when an opportunity arises, prepare Dynamic Alerts to warn you when you need to act, let the Corporate Calendar tell you when critical company events are coming and track your own decision-making process with our Personal Trading Journal.

Use our charting tools to combine technical analysis with our proprietary quantitative methodology. With 13 chart types, 33 drawing tools and over 100 studies (including our proprietary studies) to assist with your buy and sell decisions.

Trade directly through our interface with Bell Direct – an optional extra for all our members.

$1,945

$3,411

$4,789

$6,527

$1,945

$3,411

$4,789

$6,527

Yes. Our proprietary quantitative methodology has been analysing the financial statements of every company on the Australian Stock Exchange since 1996. We analyse the Financial Health of thousands of businesses within 24-48 hours of their reporting so that our members and investors can make confident and informed investment decisions. Our analysts then apply a final set of qualitative overlays to complete the assessment before making a company either a Star Growth or Income Stock. Comprehensive analysis and regular updates are provided on these companies via the Stock Doctor platform.

Absolutely. Stock Doctor includes a Portfolio Director feature that includes:

Portfolio Manager

Keeping you in total control with tax-aware, advanced performance reporting.

Portfolio Constructor

A tool which allows you to construct a portfolio based on your investment profile and objective.

Portfolio Optimiser

A tool that will help you manage your portfolio and keep you aligned to your investment objectives.

No. Lincoln Indicators is only authorised to provide general advice and does not consider your objective, financial situation or needs. However, since 1996 Stock Doctor has been helping self-directed investors and self-managed super funds (SMSF) enjoy investment success. Members gain access to exclusive quantitative research that identifies the stocks at risk of corporate failure and our Star Stocks – the stocks identified by our exclusive research methodology as having strong financial health and could be suitable to investors with long-term growth or income objectives.

To discuss the future of your investments in detail, book in a free consultation with a Lincoln representative.

To discuss the future of your investments in detail, book in a free consultation with a Lincoln financial expert.